News and Stories

-

A rare tumor and extraordinary care

January 21, 2026In the week leading up to Easter 2019, ten-year-old Danny began having headaches accompanied by vomiting. He seemed to get better with rest and pain relievers, but then the headaches would return. On the evening of Good Friday, Danny came into his parents’ room clutching his head with tears in his eyes. At some point […]Learn more A rare tumor and extraordinary care -

Ian chases possibilities, not limitations

January 20, 2026Expert care at McLane Children's helps Ian chase possibilities instead of limitations.Learn more Ian chases possibilities, not limitations -

Every breath counts

January 13, 2026Ethan’s asthma diagnosis was scary—but expert care at Baylor Scott & White McLane Children's helped him breathe easy again.Learn more Every breath counts -

A Christmas miracle

January 13, 2026A routine night of play turned into a race against time when Luka suffered a life‑threatening brain bleed, setting multiple Baylor Scott & White teams into swift, lifesaving action.Learn more A Christmas miracle -

Growing up with great care

January 13, 2026Olivia’s story is made up of small medical moments—each met with steady, reassuring care close to home.Learn more Growing up with great care -

A walking, jumping miracle

January 13, 2026After a farm accident nearly took his life, Kutter is running and smiling again—thanks to lifesaving care and donors like you.Learn more A walking, jumping miracle -

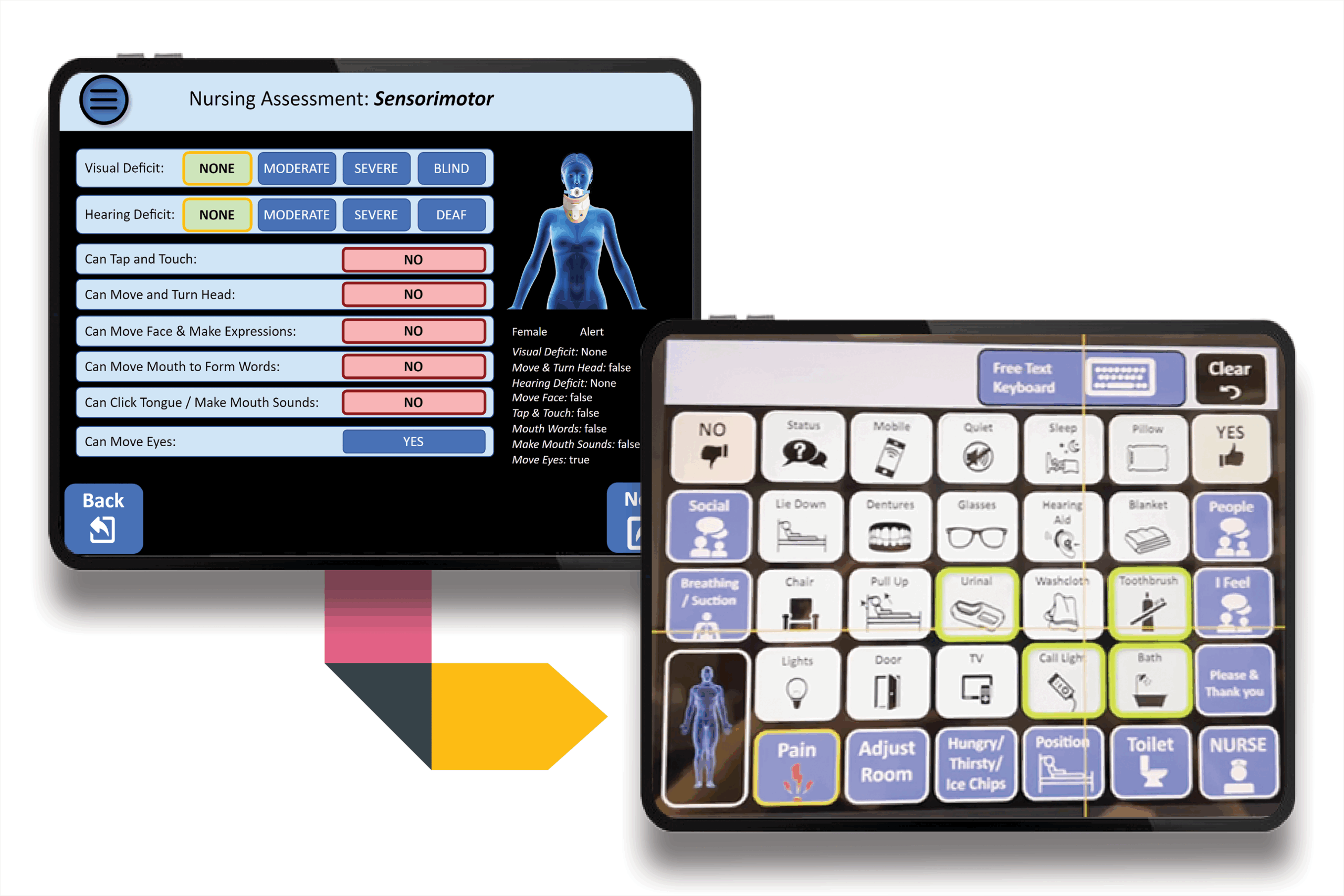

Voice to the Voiceless: Update

October 16, 2025Donor support for Voice to the Voiceless helps overcome communication barriers and give patients a voice in their care.Learn more Voice to the Voiceless: Update -

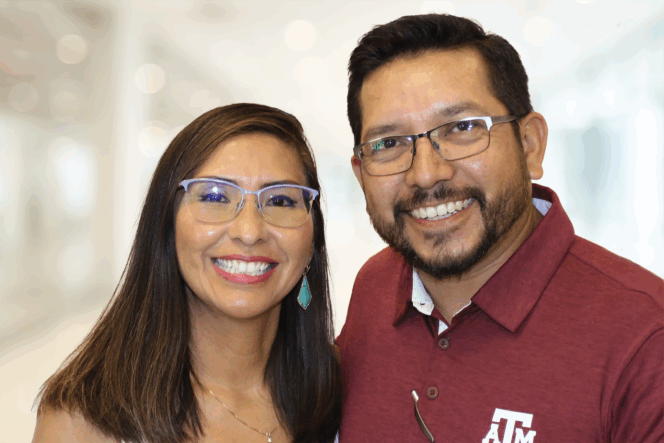

My ‘why’ will always be my family

October 16, 2025Denise Jimenez, a healthy woman in her 40s, was diagnosed with complete heart block. Thanks to her care at Baylor Scott & White, she is able to continue enjoying life with her family.Learn more My ‘why’ will always be my family -

McLane Children’s teams up with Baylor University

October 16, 2025McLane Children’s is expanding its relationship with Baylor University Athletics in a joint effort to promote healthy lifestyles and empower children and families to live well.Learn more McLane Children’s teams up with Baylor University -

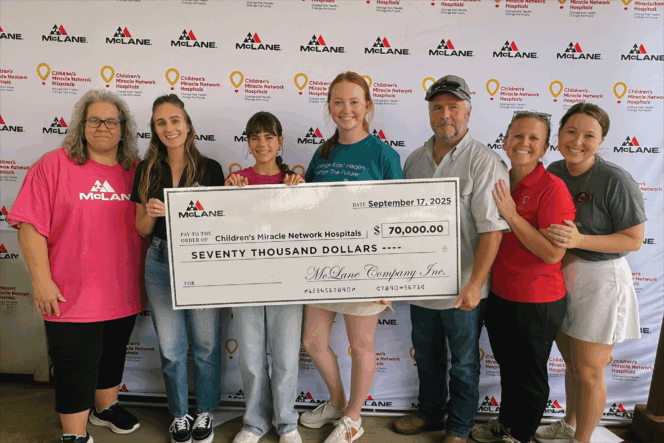

Pull! McLane Company’s Sporting Clay Shoot hits the mark for healthy kids

October 16, 2025The McLane Company's 17th annual Sporting Clay Shoot raised $70,000 for Children's Miracle Network.Learn more Pull! McLane Company’s Sporting Clay Shoot hits the mark for healthy kids -

Back on the field

October 15, 2025Thanks to expert care, Brigg is back on his feet—and back in the game. Adapted from Tex Appeal Magazine.Learn more Back on the field -

Celebrating 10 years of growing together in the Hill Country

October 15, 2025Revisit the impact of our generous donors on the past decade of quality healthcare in the Hill Country.Learn more Celebrating 10 years of growing together in the Hill Country